The Role of African Fintechs in Providing Fast Credit via Mobile Phones

Discover how mobile credit is changing everyday finance in Africa!

Discover how mobile credit is changing everyday finance in Africa!

Learn how Africa’s digital economy and e-commerce boom are reshaping personal finance and driving financial inclusion.

Explore how accessible loans for small market vendors empower local entrepreneurs and boost community growth.

Learn how global inflation impacts Africans’ purchasing power in 2025 and discover smart ways to protect your finances.

Explore how digital microcredit platforms are empowering Africans through P2P lending and driving inclusive economic growth.

Discover how young Africans are embracing fintech to learn, organize, and invest in their personal finances. Explore the tools transforming financial literacy and independence.

Discover why the Capitec Business Credit Card is a smart choice for South African entrepreneurs. Enjoy flexible credit, transparent fees, and advanced tracking tools.

Discover how the BFA Lombongo credit card combines flexibility, security, and smart digital tools to simplify your finances and enhance your spending experience.

Discover the benefits of the Nedbank Private Bundle — a premium banking solution for high-net-worth individuals. Learn how it combines luxury, security, and financial expertise.

Discover how the Moza Platinum card offers premium rewards, travel perks, top-tier security, and lifestyle benefits designed to elevate your financial experience.

Discover how the BFA Kandandu card empowers individuals and businesses in Angola with accessible, secure, and versatile financial solutions tailored to everyday needs.

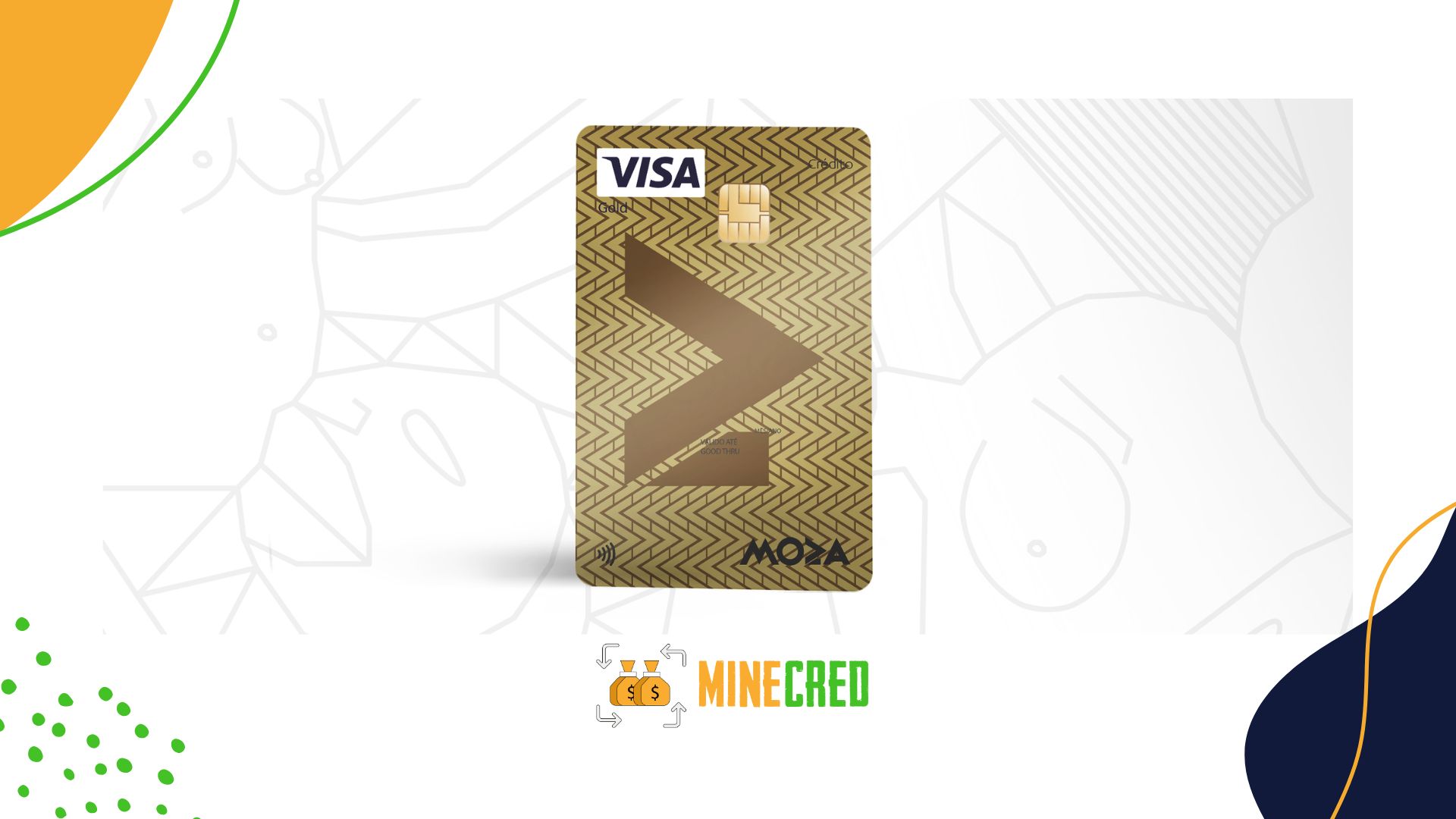

Explore the benefits of Moza Gold, a premium credit card offering unmatched cashback, travel insurance, concierge services, and elite financial perks for everyday use.

Simplify your finances with the BFA debit D’Agosto card — a secure, practical, and internationally accepted debit solution designed for effortless money management.

Unlock premium rewards, travel perks, and secure spending with the Acess Bank Visa Gold card. Discover why it’s the perfect choice for smart, modern lifestyles.

Discover the BFA Mwangolé Gold credit card and explore exclusive benefits like travel insurance, high credit limits, personalized rewards, and advanced security. Perfect for those who value prestige and financial control.

Discover the BFA debit card—secure, simple, and perfect for daily spending, budgeting, and financial freedom. No fees, just smart banking.